|

|

|

Welcome to the Innovator

Welcome to the January 2020 issue of The Innovator, a monthly newsletter for iiM, LLC. What is iiM? We are a funding platform for early-stage companies in the animal health, agriculture and human health verticals. In this newsletter, we intend to share educational information, ideas and a perspective on the investments we are making. If you do not want to receive this publication, please let us know and we’ll remove you from the list of recipients. Please enjoy this issue of The Innovator.

Lydia Kinkade, iiM Managing Director

|

|

|

Beating the Odds

According to the Small Business Administration, 600,000 businesses are started in the United States each year. Of those, only around 300 companies, or 0.05% will receive venture capital funding (Forbes). Once a company is funded, their chances of success are 1 in 2,000 (Corporate Finance Institute). What this math tells us about investing is that it’s

hard to find companies capable of generating large returns. Fortunately, iiM’s investor group is comprised of experienced entrepreneurs and executives that understand what it takes to scale a successful business. In this article, we’ll outline how we identify high-potential startups, what red flags we look for during pitches and what advice we’d give to other investors.

When entrepreneurs pitch at iiM Investor Member meetings, we evaluate the strength of the team, whether the product solves a real customer problem and the level of differentiation from their competition. When assessing the entrepreneurs, we look at their level of experience in the sector that they’re targeting and their complementary skill sets. Generally, it is advantageous to have at least one founder with strong technical capabilities and another that understands how to run and grow businesses. We also prefer that one or more executive has experience as an entrepreneur. As stated by iiM Investor Member David Morris, “I don’t want this to be their first rodeo...I want the team to have learned the hard lessons on someone else’s dime.”

Companies also need to have a clear understanding of the problem that they’re solving. As stated by Morris, “the opportunity must meet a real customer need or solve a customer problem to a magnitude that will justify from the customer’s perspective the cost or risk of changing their purchasing behavior – this seems obvious, but I think a lot of startups lose sight of this basic issue.”

In addition to having a strong team and product-market fit, founders need to be transparent. “When a founder is unwilling to share information or answers questions in a vague manner it does not send a healthy signal,” said R. Lee Harris, Managing Member of iiM. In fact, iiM recently passed on an opportunity because the CEO would not explain how their technology solved the problem that they were claiming to address.

Another reason that iiM will walk away from a deal is if they cannot agree on the terms. “One company [that] we considered recently planned to use a significant part of the proceeds from funding to reimburse the founders for their investment – that’s a big no-no. Another [firm] created terms and conditions that were much more advantageous to the founders and actually detrimental to iiM,” said Harris.

Finally, the entrepreneurs must be able to justify their financial projections and the underlying assumptions behind them. For example, the CEO should be able to describe in detail their plan for increasing revenue by millions of dollars year-over-year and what is driving their expenses.

If founders meet all these criteria - a balanced team with a strong product-market fit, fair terms and realistic financial goals - they are likely to secure an investment from iiM. Great companies are hard to find, but they do exist. The key thing to remember as an investor is to have discipline. As stated by Harris, “Patience is critically important in this process. I’ve learned not to ‘force’ investments. When a deal falls apart...it’s because something better is in store.”

Natalie Berigan Kuster, iiM Consultant

|

|

|

Venture Investing Terminology

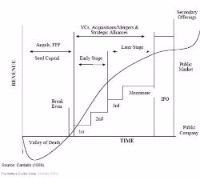

There are many terms in the venture capital world that can be confusing. As we look at various companies and meet with their founders, you may hear us use some of this terminology. Here are a few such terms and what they mean.

Cap (or Capitalization) Table– a table providing an analysis of the founders' and investors' percentage of ownership, equity dilution, and value of equity in each round of investment.

Capped Note– places a cap on the value of the company at which an investor’s debt converts to equity. Ex: a $500,000 investment translates to a 10% stake in a company with a cap of $5M.

Full Ratchet– a form of antidilution protection that sets the conversion price for preferred stock in relation to the price of a new round of shares, regardless of how many new shares are issued. Ex.: If there were 100 shares of stock issued during the first round at $1 per share, even if the company only issues 10 more shares during the next round, but they do it at 50 cents per share (this would be a down round), then the new conversion price is 50 cents. Compare with weighted average.

Harvest Period– the period in which the fund begins to see returns from its investments through mergers and acquisitions, initial public offerings, technology licensing agreements, and other means.

Internal Rate of Return (IRR)–the annualized effective compounded return rate that can be earned on the invested capital, otherwise known as the investment’s yield. The longer the money is tied up in an investment, the higher the multiple of the original investment that must be returned to have an adequate Internal Rate of Return.

|

|

|

The iiM Syndicate

iiM began expanding its syndicate in 2018. The iiM Syndicate entitles its members to participate in all the iiM meetings and pipeline calls; review prospective investments; view due diligence materials and invest only in those companies that each member chooses. And, an investment can be as little as $5,000.

Why a syndicate? Syndicate members invest alongside iiM Investor Members to produce a cumulative capital investment that is meaningful to new portfolio companies. Further, if the capital commitment is large enough, iiM may be in a position to lead the investment round and secure even better terms and conditions for all investors. In one investment, Investor and Syndicate members pooled capital totaling $530,000 to invest in a Series A Preferred Stock round. Syndicate members must be Accredited Investors and pay $2,500 per year to participate.

|

Another reason for developing the iiM Syndicate is to have more talent and brainpower “around the table.” Syndicate members offer questions during company interviews and make valuable observations during the post-interview analysis discussion. iiM has extensive domain expertise within the three targeted verticals – animal health, agriculture and human health – as well as deep entrepreneurial experience. Syndicate members bring domain expertise as well as an entrepreneurial perspective that is invaluable to the vetting process. As a result, iiM is a very unique early-stage company funding platform that is unlike almost every other such platform in the industry.

iiM investments are structured more like a venture capital firm than an angel or seed stage funder. Ultimately when there is a capital event, iiM Investors and Syndicate Members first receive a return of their invested capital plus a 10% non-compounded annual return. Thereafter, the iiM Investors receive 20% of the excess benefits and Investors and Syndicate Members receive 80%. The 20% “Promotional Interest” is distributed in part to the iiM Managing Director (Lydia Kinkade) and its counsel (Philip Krause), and is also used to pay any outstanding operational expenses, with the remainder being paid to Investor Members.

|

Each investment is structured as a separate limited liability company. K-1s are generated for each entity and provided to Investor and Syndicate Members based upon their participation. While not required, it is hoped that Syndicate Members will consider taking a dollar-cost-averaging approach to making investments in early stage companies. It’s very hard to predict which companies will succeed and which will fail. Investing similar amounts in each company will ensure that a Syndicate Member won’t miss out on those companies that are winners.

If you are interested in becoming an iiM Syndicate Member, we would welcome you to be our guest at an upcoming meeting or pipeline call. Please call or e-mail Lydia Kinkade, Managing Director, at (913) 671-3325 or lkinkade@iimkc.com.

|

|

|

A Look at a Portfolio Company

We are pleased to currently have nine companies in the iiM portfolio with due diligence underway for additional investments. One of our portfolio companies is Mobility Designed, based in Kansas City, MO.

Mobility Designed (M+D) is a durable medical equipment designer, manufacturer and online retailer of ambulatory aids. Their mission is to deliver a radically improved end user experience and address key issues of compliance and profitability for medical staff and the retail channel. Key

areas defining the state of the poor patient/user experience include:

- Severe pain ranging from the hand, wrist, elbow, shoulder and back.

- Debilitating injuries resulting from over use/exertion including carpal tunnel.

- Disruption of everyday life activities which over the longer term lead to reduced social engagement.

The M+D Crutch® is a revolutionary mobility aid, improving user experience by relieving the severe discomfort and disruption to everyday life. Additionally, it precludes the debilitating injuries normally associated with crutch use.

The M+D Crutch® cradles the user’s elbow and forearm in an ergonomically designed position that evenly distributes body weight and offers safe, efficient, and pain-free mobility. The crutches are easy to use and offer significant lifestyle enhancements, including a rotating handle for hands free walking, customizable arm bands, an unlocking arm cradle that enhances freedom of motion, and interchangeable feet.

iiM invested in Mobility Designed through a convertible note in March 2017 which converted to Series A Preferred Stock in December 2018. iiM also provided an additional investment to help close the Series A round in July 2019.

https://www.mobilitydesigned.com/

|

|

|

About iiM

iiM (Innovation in Motion) is a funding platform for early stage companies in the Animal Health, Human Health and Agricultural verticals. The company invests $100,000 - $500,000 in selected companies. iiM is building a diversified portfolio of companies – currently there are nine with commitments to fund at least three more – with a target of at least 30 to 40 portfolio companies. A professional staff guides 25 investors making investments across the United States and Canada.

The iiM Syndicate is open to Accredited Investors who wish to invest in as few or as many companies alongside the iiM investor members. Syndicate members are invited to attend iiM’s regular meetings, participate in pipeline calls and review all due diligence materials.

If you are interested in attending an iiM meeting or want more information about the iiM Syndicate, please contact Lydia Kinkade, Managing Director, at lkinkade@iimkc.com or (913) 671-3325. The iiM website is http://www.iimkc.com.

|

|

|

A place for entrepreneurs with great ideas.

|

|

|

|

|

| |

|

| |

|

|