|

|

|

Welcome to the Innovator

Welcome to the May 2020 issue of The Innovator, a monthly newsletter for iiM, LLC. What is iiM? We are a funding platform for early-stage companies in the animal health, agriculture and human health verticals. In this newsletter, we intend to share educational information, ideas and a perspective on the investments we are making. If you do not want to receive this publication, please let us know and we’ll remove you from the list of recipients. Please enjoy this issue of The Innovator.

Lydia Kinkade, iiM Managing Director

|

|

|

Virus-Vetted Thoughts on Risk Factor Disclosures

A key piece of good disclosure in offering documents used to raise investment capital is the “risk factors” section. This section is used to highlight important risk factors a prospective investor should consider in making an investment decision. Its tone is the opposite of good salesmanship—here are all the reasons not to make this investment! Companies often want to use “boiler-plate” disclosure language or fail to give careful thought to the true risk factors their business can face. They simply do not want to discuss the potential downside to investing in their business.

The COVID-19 crisis provides a gut-punch reality check on giving careful thought to risk factor disclosures. The picture posted nearby shows the parking lot I can see from my office window. The picture is taken mid-morning on what would otherwise be a typical business day, and ordinarily nearly every slot would be filled with other cars circling to find a scarce empty space. Who was thinking last week about the implications of a two-week or longer near total shut down of business activities across the entire economy? We are now discovering in real time how staggering the risk factors were. As the picture shows, what looked sunny and hopeful just last week, today looks dark and overcast.

Risk factors need not predict the future. Yet they really must identify the key risks currently embedded in the business. The metric for evaluating what risk factors need to be disclosed is, “what would a reasonably prudent investor want to know in making an informed investment decision.”

If risks factors were being written this week instead of last week, I daresay they might be addressing issues such as:

- Is our supply chain secure or at risk for disruption, and does it have built in redundancies?

- How stable or sustainable is our customer base?

- How is our business affected in the event of significant stock market variations, or dramatic fluctuations in interest rates?

- Is our existing technology robust enough to facilitate significant numbers of employees working remotely?

- Do we have established succession planning and redundancy for key employees?

- Are we adequately capitalized to weather significant short-term disruptions in cash flow?

The list of these issues is limited only by our imagination. While some risk factors are systemic, others are distinctive or unique to a specific business plan. An investor is entitled to know them, and the company has a responsibility to make them known prior to taking the investor’s money.

Philip Krause, iiM Legal Counsel

|

|

|

Venture Investing Terminology

There are many terms in the venture capital world that can be confusing. As we look at various companies and meet with their founders, you may hear us use some of this terminology. Here are a few such terms and what they mean.

Board-Observer Rights – Even if they don’t get a vote, this person sits on the board and observes. They lean back, letting the founders do what they are going to do, and guide the conversation when necessary. They might not be able to vote, but they can still influence events (plus, everything they “observe” goes back to the VC).

Carried Interest – Profit of a VC fund (i.e. returns in excess of the original investments and other costs) is typically divided between the Limited Partners and the VC firm in an 80/20 split. Additionally, most funds have a hurdle rate, a minimum rate of return delivered to LPs before starting to receive any profit.

J-Curve –This is the curve of value creation over time that is typical in a venture capital fund. The value of VC portfolio (consisting of several separate investments) goes first down but starts later climbing up despite some of the portfolio investments being totally unsuccessful – the few real home runs can return over 10x the investment made.

Monthly Active Users (MAU) – Monthly active users (MAU) is a key performance indicator (KPI) used by social networking and other companies to count the number of unique users who visit a site within the past month. Websites generally recognize monthly active users via an identification number, email address, or username.

Subscription Model – The subscription model is a business model in which a customer must pay a recurring price at regular intervals for access to a product. The model was pioneered by publishers of books and periodicals in the 17th century, and is now used by many businesses and websites.

|

|

|

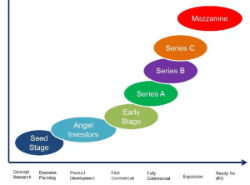

Venture Funding Stages

Everyone knows that starting and growing a business requires capital. Many founders start with the dream that they will always own 100% of their business and avoid using debt and outside equity. Unless they are starting with significant personal wealth, this often becomes a pipedream. Usually the founder scrapes together his or her own savings and taps family members and close friends (and sometimes not-so-close friends) and starts the business on a shoestring. We often call this round of funding “FFF” for Founder, Family and Friends. It is also called Pre-Seed Funding and the amounts may range from $50,000 to $150,000 though it could be more in some cases.

|

Eventually the founder realizes that more capital is going to be needed and takes the first official step toward outside ownership through a Seed Funding round. Seed Funding can come from Angel Investors like iiM. Other seed funders can be incubators and syndicates. Funding can be structured as a convertible note or as preferred equity. The convertible note is debt that eventually will convert to preferred equity. Preferred equity is a more direct and simpler path for all parties, but it involves agreeing upon a valuation for a company that likely has little or no revenue, much less profits. Seed-stage funding can encompass varying amounts from $300,000 to $2 million or more.

As the company grows and refines its product or service, more capital may be necessary to expand. This could be necessary to hire a sales team, purchase equipment or ramp-up manufacturing operations. At this point, the company has some level of product-market fit, revenue and a growing customer base. Funding at this stage, called Series A, could range from $2 million to $15 million, with valuations as high as $25 to $40 million. Series A funders will generally be the more traditional venture capital firms and often are “led” by a single investment firm that organizes the funding round for the company. iiM also invests in Series A funding rounds.

|

Once a business moves beyond the development stage and is achieving scale, more capital may be needed to expand into new markets and product lines. The company that is looking for Series B funding is often profitable and has a strong customer base. Investors at this stage are much more likely to be larger venture capital firms that can invest in companies with valuations ranging between $30 and $60 million or more. Again, there is typically a lead investor and recent research found that the average amount raised in a Series B round to be $32 million. Companies that raise at this level often become candidates to be acquired by much larger firms providing an exit for all the investors to that point.

Successful companies may look to Series C for even more capital to do what they are already doing on a much larger scale. Less risk is involved at this level and hedge funds and private equity firms may be players in this space as well as traditional venture capital firms. Valuations at this stage may be $100 million and even more. Some firms may pursue additional rounds of funding – Series D, E, etc. At Series C and beyond, companies are often positioning to go public through an IPO or Direct Listing.

The various stages of capital funding for businesses usually takes many years. Facebook was founded in 2004 and went public in 2012. The founder’s percentage of ownership is diluted with each round of funding. But the whole premise is that he or she will eventually benefit from a smaller share of a much, much larger pie, than if the business were to have remained a small enterprise.

R. Lee Harris, iiM, LLC, Managing Member

|

|

|

A Look at a Portfolio Company

We are pleased to currently have ten companies in the iiM portfolio with due diligence underway for additional investments. Our newest portfolio company is Centese, based in Omaha, NE.

Current legacy chest drainage leads to complications and unnecessarily long lengths of stay. Specific problems include: Chest tube clogging in 36% of patients and drainage-related complications in 19% of patients which leads to 5x increase in mortality, 3-day increase in length of stay, 4x increase in time of ventilation. Additional issues include: 1-day increase in length of stay from subjective data, limited patient mobility with lack of portable suction, manual data collection creates errors.

|

Centese has developed Thoraguard™, an FDA-cleared medical device built around patented technology. Thoraguard is a first of its kind digital surgical drainage system that addresses the issues of current analog devices. Thoraguard uses intelligent sensors and software to improve outcomes and reduce costs in cardiothoracic surgery. The need has been validated in published literature demonstrating the clinical and financial benefit of improved drainage. Complications resulting from current legacy systems cost the average target hospital $3 million annually. Centese was awarded grants from the National Science Foundation and State of Nebraska and raised a Series A from institutional investors in 2017.

iiM made an initial investment in Centese through a convertible note for a bridge round to Series B funding in 2020.

https://www.centese.com/

|

|

|

About iiM

iiM (Innovation in Motion) is a funding platform for early stage companies in the Animal Health, Human Health and Agricultural verticals. The company invests $100,000 - $500,000 in selected companies. iiM is building a diversified portfolio of companies – currently there are ten with commitments to fund at least two more – with a target of at least 30 to 40 portfolio companies. A professional staff guides 25 investors making investments across the United States and Canada.

The iiM Syndicate entitles its members to participate in all the iiM meetings and pipeline calls; review prospective investments; view due diligence materials and invest only in those companies that each member chooses. And, an investment can be as little as $5,000.

Why a syndicate? Syndicate members invest alongside iiM Investor Members to produce a cumulative capital investment that is meaningful to new portfolio companies. Further, if the capital commitment is large enough, iiM may be in a position to lead the investment round and secure even better terms and conditions for all investors. In one investment, Investor and Syndicate members pooled capital totaling $530,000 to invest in a Series A Preferred Stock round. Syndicate members must be Accredited Investors and pay $2,500 per year to participate.

If you are interested in attending an iiM meeting or want more information about the iiM Syndicate, please contact Lydia Kinkade, Managing Director, at lkinkade@iimkc.com or (913) 671-3325. The iiM website is http://www.iimkc.com.

|

|

|

| |

|

| |

|

|