|

|

|

Welcome to the Innovator

Welcome to the August 2020 issue of The Innovator, a monthly newsletter for iiM, LLC. What is iiM? We are a funding platform for early-stage companies in the animal health, agriculture and human health verticals. In this newsletter, we intend to share educational information, ideas and a perspective on the investments we are making. If you do not want to receive this publication, please let us know and we’ll remove you from the list of recipients. Please enjoy this issue of The Innovator.

Lydia Kinkade, iiM Managing Director

|

|

|

How Covid-19 is Disrupting the Meatpacking Industry

|

“Sometimes life changes in the blink of an eye, and the world as we know it is different. Anxiety, doubt, and the fear of the unknown are now our constant companions...It hasn’t been easy, and it’s not over. But I have faith that together, we’ll get through this. We will continue to bring new ideas to the table, solve new problems, and create new opportunities. We must come together to keep our nation fed, our country strong, and our employees healthy,” said John Tyson, Chairman of Tyson Foods, in a company statement in April.1 Although, sustaining operations while keeping employees safe has not been easy for our nation’s food suppliers. In April and May alone, 17,300 meat and poultry processing workers in 29 states were infected and 91 died, leading to plant shutdowns that reduced U.S. beef and pork production by more than one-third in late April.2 This resulted in limits on the number of packages of meat that could be purchased from grocery stores at any one time and restaurants being sold out of our favorite dishes. As Covid-19 continues to spread across the globe, meatpacking producers are realizing the important role that technology and automation will play for their companies now and in the future. This article will highlight innovative solutions that are being developed to keep employees safe and combat long standing issues, such as labor shortages, that will remain even after the pandemic ends.

Meat processing facilities have always suffered from labor supply issues. According to the Wall Street Journal, annual turnover in meatpacking plants ranges from 40% to 70%, compared to an average of 31% for other manufacturing jobs.2 This is due to the repetitiveness of the work and hazards that laborers are exposed to on the job, including chemicals and pathogens, traumatic injuries from machines and tools and musculoskeletal disorders.3 Recruiting and retaining workers has become even more difficult during the pandemic as plants across the country have become hotspots for outbreaks of the disease.

|

As a result, industry leaders have begun investing heavily in robotics. In fact, in the last three years, Tyson Foods has spent $500 million on technology and automation; that number is expected to increase in the aftermath of the pandemic.2 Some of the most important advancements that are being made are the ability to slice and debone livestock, tasks that have traditionally been difficult to automate due to the variability of each animal. As stated by Megan Molteni, writer for Wired,

“Getting robots to do the job of human butchers isn’t trivial. Like lettuce and apples, animals come in all shapes and sizes. And though farmers can try to make them as genetically similar as possible and feed them the same amount of food, two pigs will never be identical in the way two smartphone batteries are.”

Fortunately, the technology is improving. Pilgrim’s Pride Corp., a chicken processor that is owned by JBS SA, reported that deboning machines now trail humans by only 1% to 1.5% in terms of meat yield per chicken.2 Researchers at the Danish Meat Research Institute (DMRI) are applying technologies from the automotive and warehouse industries, such as computer vision, machine learning and virtual simulations, to improve the accuracy of meat-processing robots.4 According to Lars Hinrichsen, Head of the DMRI,

“the best [robots] can’t just follow programmed cutting patterns...The best ones have to be able to digitally peer inside a carcass, see where the bones are, estimate how much each cut will weigh, and figure out how to divvy it up to optimize for whatever orders are coming in.”4 Eventually, Hinrichsen envisions humans and robots working alongside each other to completely break down one animal at a time. Robots will perform the repetitive butchering tasks, and humans will monitor the machines to ensure accuracy and prevent breakdowns.4

Although meat processing companies were beginning to integrate robotics into operations prior to the pandemic, Covid-19 has accelerated the need to replace manual labor with automated technology. By reducing the number of repetitive tasks that workers are required to perform, such as cutting and deboning livestock, meat packing facilities will increase output, reduce bottlenecks and on-the-job injuries, and protect themselves against labor shortages.4 As stated by Doug Foreman, Director of Manufacturing Technology for Tyson Foods,

“Automation is something [that will be] revolutionary for our business. We are on the cusp of a significant rollout.”2

1Tysonfoods.com

2Bunge, J., & Newman, J. (2020, July 09). Tyson Turns to Robot Butchers, Spurred by Coronavirus Outbreaks. Retrieved August 02, 2020, from https://www.wsj.com/articles/meatpackers-covid-safety-automation-robots-coronavirus-11594303535

3Gibson, K. (2016, May 31). Just how dangerous is meat and poultry packing? Retrieved August 02, 2020, from https://www.cbsnews.com/news/meat-and-poultry-work-is-dangerous-but-not-all-injuries-counted/

4Molteni, M. (2020, May 25). Covid-19 Makes the Case for More Meatpacking Robots. Retrieved August 02, 2020, from https://www.wired.com/story/covid-19-makes-the-case-for-more-meatpacking-robots/

Natalie Berigan Kuster, iiM Consultant

|

|

|

Venture Investing Terminology

There are many terms in the venture capital world that can be confusing. As we look at various companies and meet with their founders, you may hear us use some of this terminology. Here are a few such terms and what they mean.

Accelerator – The speed ramp that takes startups from adolescence to something resembling early adulthood. Accelerator programs typically last three to six months (as opposed to incubators, which have longer time spans) and are meant to help startups that are already performing scale up and create the organizational framework that they’ll need to thrive.

Incubator – Offices that bring together seasoned and rookie entrepreneurs of all kinds to help each other grow. They give startups the resources that they need to succeed: a place to sit and meet with clients, networking opportunities, office support, etc.

Lifestyle Business – A lifestyle business is created and run by its founder to serve the purpose of sustaining a particular level of income, and no more. Often founded by an individual, lifestyle businesses create a foundation for enjoying a particular lifestyle, bringing in just enough revenue to meet the owner’s personal needs. iiM does not invest in Lifestyle Businesses because the upside is limited.

Pre-Money Valuation – The value of a company before investment.

Weighted Average – This is a more moderate antidilution protection approach that uses a formula that takes into account not only the share price of the new issuance, but also the old stock price, number of shares issued, and number of shares overall. It’s more moderate than a full ratchet, which sets the new price without respect to any of these factors.

|

|

|

North America Q2 Venture Report: Funding Down as Expected

By Sophia Kunthara

This article is reprinted from Crunchbase News.

In March, as we all began to fully wrap our heads around the potential impact of the COVID-19 pandemic, the future of startup funding seemed clearly in jeopardy.

Many hypothesized that there would be a slowdown in funding and fewer deals made. The logistics of how firms could invest in a company and teams they’ve never met was a whole new obstacle. Further, how investors commit with confidence amid such uncertainty in the world was (and is) a major challenge.

But investors adapted and deals still happened.

However, with the end-of-quarter data in hand, we see that venture dollars invested in North American startups were down for the first half of the year compared to the first half of last year. The same was true specifically for the second quarter.

In general, funding counts for the most recent quarter will be lower as funding rounds are added after the quarter closes. Typically, the data lag is greater at the seed and early funding stages. Funding amounts are less impacted as larger funding rounds are more likely to be announced in a timely manner.

(For more on this, see our Methodology section below).

According to Crunchbase data, $64 billion was invested in North American startups (companies based in Canada and the United States) in the first half of 2020. That’s down 10 percent compared to the same period in 2019, when $70 billion was invested.

(In the accompanying chart, the actual 1-H 2020 number may shift slightly given reporting delays. See Methodology description below for more details.)

The chaos surrounding COVID-19 in the United States really started in March, basically toward the end of the first quarter. So, the reality check came in the second quarter.

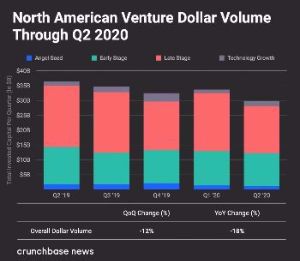

The second quarter of 2020 was the first full quarter in the new COVID-19 world, and during that time $29.8 billion was invested in North American startups–18 percent less than the same period last year and 12 percent less than the previous quarter.

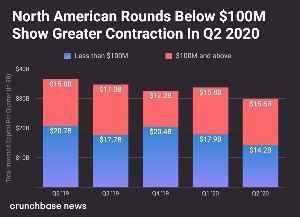

The majority of VC funding raised throughout Q2 was in supergiant rounds, or those of $100 million or more. Although supergiant rounds were flat year over year, rounds below $100 million were down 31 percent year over year.

The overall dollar volume for VC funding in North America was down for the second quarter of 2020 compared to the same period last year and the number of deals was also down for companies across all stages.

Funding by stage

A few data points to consider by funding stage:

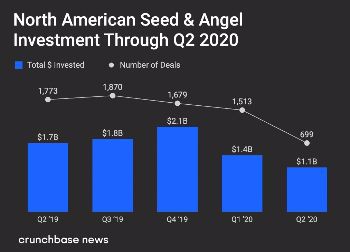

- Seed and angel investment saw $1.1 billion across 699 deals in the second quarter of 2020, down from $1.7 billion across 1,773 deals in the second quarter of 2019.

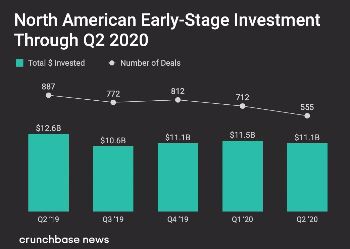

- Early-stage investment saw $11.1 billion invested across 555 deals in Q2 2020, down from $12.6 billion across 887 deals in Q2 2019.

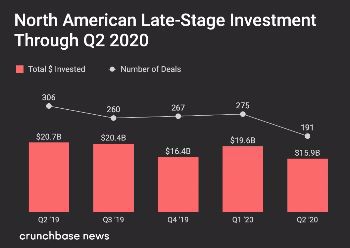

- Late-stage saw $15.9 billion invested in Q2 2020 across 191 deals, compared to $20.7 billion across 306 deals in Q2 2019.

Notable large funding rounds include Waymo’s $750 million raise, Sana Biotechnology’s $700 million Series A, and Stripe’s $600 million Series G. Airbnb had the largest raise of the quarter for a VC-backed company, taking in $1 billion as the travel industry took a hit due to COVID-19. The round came from private equity firms Silver Lake and Sixth Street.

Exits

Exits also took a hit in Q2. Acquisitions of venture-backed North American companies (that hadn’t previously gone public) were down significantly in Q2 2020–for acquisitions with disclosed amounts–compared to all of the past year. There were 177 acquisitions totaling $9.7 billion in Q2 2020, down from 278 acquisitions totaling $21.7 billion for the year-ago period.

Part 2 of this article will appear in the September 2020

Innovator.

|

|

|

A Look at a Portfolio Company

We are pleased to currently have ten companies in the iiM portfolio with due diligence underway for additional investments. One of our portfolio companies is Envara Health, based in Wayne, PA.

Envara Health is a human health company which has created a structured lipid that enables the absorption of long chain fats, essential fatty acids, and certain micronutrients without the need for digestive enzymes. Their structured lipid, called LXS, has been crafted to solve the problem of malnutrition, which affects over one billion people worldwide. Encala® was tested in a large NIH funded clinical study at 10 certified cystic fibrosis centers and found safe and effective. Invented by the late Dr. David Yesair, PhD, an internationally recognized biochemist, and patented under the original registered trademark, Lym-X-Sorb, Encala® was inspired by and developed for patients with cystic fibrosis who struggle with malabsorption.

iiM made an initial investment in the company’s Series A Preferred Stock round on January 16, 2019.

https://envarahealth.com/

|

|

|

About iiM

iiM (Innovation in Motion) is a funding platform for early stage companies in the Animal Health, Human Health and Agricultural verticals. The company invests $100,000 - $500,000 in selected companies. iiM is building a diversified portfolio of companies – currently there are ten with commitments to fund at least two more – with a target of at least 30 to 40 portfolio companies. A professional staff guides 25 investors making investments across the United States and Canada.

The iiM Syndicate entitles its members to participate in all the iiM meetings and pipeline calls; review prospective investments; view due diligence materials and invest only in those companies that each member chooses. And, an investment can be as little as $5,000.

Why a syndicate? Syndicate members invest alongside iiM Investor Members to produce a cumulative capital investment that is meaningful to new portfolio companies. Further, if the capital commitment is large enough, iiM may be in a position to lead the investment round and secure even better terms and conditions for all investors. In one investment, Investor and Syndicate members pooled capital totaling $530,000 to invest in a Series A Preferred Stock round. Syndicate members must be Accredited Investors and pay $2,500 per year to participate.

If you are interested in attending an iiM meeting or want more information about the iiM Syndicate, please contact Lydia Kinkade, Managing Director, at lkinkade@iimkc.com or (913) 671-3325. The iiM website is www.iimkc.com.

|

|

|

| |

|

| |

|

|