|

|

|

Welcome to the Q4 2022 issue of The Innovator, a quarterly newsletter for iiM, LLC. What is iiM? We are a funding platform for early-stage companies in the animal health, agriculture, and human health verticals. In this newsletter, we intend to share educational information, ideas, and a perspective on the investments we are making. If you do not want to receive this publication, please let us know and we will remove you from the list of recipients. Please enjoy this issue of The Innovator.

Lydia Kinkade, iiM Managing Director

|

|

|

|

|

How to Become a Great Entrepreneur

By R. Lee Harris, iiM Managing Member

|

|

|---|

|

At iiM, we look at a lot of start-up companies and evaluate their founders and product or service ideas. Over the years we’ve identified several founder attributes that are needed for entrepreneurial success in the start-up world. So, what traits and tendencies does the ideal founder possess?

A clear vision is at the top of the list. I’ve said before that vision is what it looks like when we get there. A great entrepreneur can articulate with clarity what the future looks like for his or her company and the products/services that it provides. For example, here’s an example of a clear vision statement – “To become the world’s most loved, most flown, and most profitable airline.” It’s clear what it looks like when Southwest Airlines “gets there.” Of course, the appropriate metrics can be layered onto this vision to quantify it.

Not only must a great entrepreneur be able to explain the vision for the company, but he or she should be able to constantly communicate clearly and effectively across a wide range of topics. We’ve funded some promising companies that have high potential for success. Unfortunately, the founders are tone deaf when it comes to staying in touch with their investors. We must always think about what others need to know. You’ll go a long way to building confidence with us if you communicate proactively and we don’t have to chase you for status updates.

We are reluctant to fund solo founders. There’s simply too much risk when betting on a single individual to grow a business and make all the right decisions. Instead, we are looking for a founding team that offers strong domain expertise and business acumen. A great entrepreneur can assemble such a team and retain them to build a great company.

The entrepreneurial world is a rough and tumble business. Setbacks are experienced every single day and can really take a toll on morale over time. We’re looking for founders that can get off the ground, brush themselves off and get back on the horse. An almost stubborn resilience is highly valued and is requisite for another quality – perseverance. Patience does not come easy for entrepreneurs – we want things to happen yesterday. As an angel investor, we need to know that not only will a founder be able to bounce back from adversity but will also stick to his/her plan over the long haul.

Great entrepreneurs have high levels of energy. Their energy is palpable and contagious. Moreover, they are indefatigable and can outwork everyone. Entrepreneurship requires a great deal of stamina, and you’ll never hear a top-flight founder say that there aren’t enough hours in the day. He or she simply figures out a way to manufacture more hours!

There’s no question that passion is a quality that is a mandatory element of success. When we’re listening to a founder’s pitch, it’s obvious if there’s passion. He or she exudes confidence and is inspirational when explaining the product or service. This enthusiasm is powerful in persuading customers, investors, and other stakeholders to say yes.

Finally, we’re looking for entrepreneurs that know their stuff. They have mastered the facts and avoid the B.S. I remember one pitch session where a founder was asked about his projections and how he justified capturing such a large market share. His response was, “We’ve studied the market and don’t see much competition. So, we think we can hit our target.” This was a classic B.S. response unsupported by any factual evidence. Needless to say, he didn’t get funded. Contrast this with a similar response from another founder who answered the same question. She walked us through the various factual assumptions that built to a market share that felt realistic to us. It was quite clear she had done her homework.

Great entrepreneurs – whether they are founders or not – possess traits and tendencies that constitute a winning formula. A clear vision; clear communications; the ability to assemble and retain a team; resilience; perseverance; energy and indefatigable spirit; passion; mastery of the facts, and avoiding B.S., are what we look for when interviewing great entrepreneurs.

This blog is being written in tandem with Lee’s book, “An Entrepreneur’s Words to Live By,” available on Amazon.com in paperback and Kindle (Amazon Link

), as well as being available in all of the other major eBook formats.

|

|

|---|

|

Venture Investing Terminology

|

|

|---|

|

There are many terms in the venture capital world that can be confusing. As we look at various companies and meet with their founders, you may hear us use some of this terminology. Here are a few such terms and what they mean.

Burn Rate – The rate at which a company is spending the external capital it has raised – typically expressed over one month. Sometimes, a further distinction is made between gross burn and net burn. Gross burn refers to the sum total of cash that a company is spending, while net burn is the cash it’s losing after revenue.

Liquidation Preference – This is one of the key terms by which preferred shareholders are given priority in a liquidation event. Here, “liquidation” refers not only to an actual liquidation of a company through dissolution or bankruptcy, but also to the company being sold. Note that IPOs don’t constitute a liquidation event, but should be considered just another funding round, so liquidation preferences don’t apply. What’s more, in most cases, all preferred stock is converted to common stock ahead of an IPO.

Liquidation preferences are expressed as a multiple of the original sum that an investor invested. A 1x liquidation preference means that, in the event of an exit, an investor will receive the original sum they invested before other shareholders receive anything. Liquidation preferences are a key part of term sheet negotiations. 1x is the standard multiple, and founders should certainly be wary of agreeing to anything above. This multiple, and liquidation preferences in general, are inherently related to participation rights

Most Favored Nation – A Most Favored Nation clause, or MFN clause as it is commonly known, protects an investor by giving them the same rights and benefits received by later investors, if those rights and benefits are more favorable than those originally agreed. The primary purpose of an MFN clause in an investment agreement is to give investors comfort that they will not be disadvantaged compared to other investors in subsequent rounds, thus maximizing their potential returns.

Pari Passu – In each consecutive funding round, the investors in that round will be issued a new series of preferred stock – each with liquidation preferences (see: liquidation preference). There are two ways in which those preferences can be prioritized relative to each other. Firstly, the preferences can be stacked so that the investors of the most recent round get their preference first, and so on (i.e. Series B preferred before Series A preferred). Secondly, the preferences can be made equal in status – called pari passu – in which case all holders of preferred stock participate ratably until all preferences have been returned.

Find more venture investing terminology here.

|

|

|---|

|

Hospital for Special Surgery and Lumoptik, Inc. Announce a Collaborative Relationship Centered on Epidural Anesthesia Innovation

|

|

|---|

|

Note: Lumoptik is an iiM Portfolio Company

|

|

|---|

|

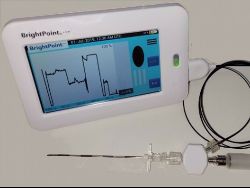

NEW YORK and SPRING GROVE, Ill., Oct. 13, 2022 /PRNewswire/ -- Hospital for Special Surgery (HSS), the world's leading academic medical center focused on musculoskeletal health, and Lumoptik, Inc. (Lumoptik), a development stage medical device company with a first-in-kind proprietary light-based technology, today announced a new collaborative relationship. Lumoptik and HSS aim to develop cutting-edge technologies and products to assist with epidurals, pain management procedures and other potential orthopedic and neurology uses, in addition to clinically evaluating Lumoptik's BrightPoint™ System for assisting with epidurals. This unique relationship combines the clinical expertise of HSS's world-class Department of Anesthesia and Pain Management with Lumoptik's BrightPoint™ platform technology and product development capabilities to improve how patient care is delivered.

|

The BrightPoint™ Epidural Needle Guidance System, Lumoptik's first product, is a low cost, easy to use device which can help clinicians better perform epidurals using the standard-of-care Loss of Resistance (LOR) technique. BrightPoint™ utilizes a specialized reflectometer that shows the clinician the color of the tissue at the tip of the needle in real time while inside the patient, thus providing an additional, objective indication that the needle is in the correct position. BrightPoint™ is designed to work as part of the LOR technique, in combination with standard needles and syringes and can help clinicians perform LOR epidurals more safely and reliably than traditional methods.

"HSS looks forward to working with Lumoptik to evaluate and assess the BrightPoint™ Epidural Needle Guidance System and work on new uses for Lumoptik's innovative platform technology," said Michael P. Ast, MD, chief medical innovation officer and a joint replacement surgeon at HSS. "This partnership is a great example of HSS being able to leverage all areas of its expertise, including anesthesia, in improving musculoskeletal care."

Read the rest of this story about Lumoptik here

|

|

|---|

|

Axiota Animal Health and Resilient Biotics Enter Multi-Product Agreement

|

|

|---|

|

Fort Collins, Colo. — October 18, 2022 — Today Axiota Animal Health, a global animal health company based in Colorado, announced a development and licensing agreement with Resilient Biotics, a North Carolina-based company pioneering new microbiome-based animal products using advanced multi-omic approaches, data science, and in vitro screening technologies. The agreement grants Axiota exclusive global rights to Resilient Biotics’ proprietary treatment of bovine respiratory disease (BRD) and further collaboration with Resilient Biotics for additional product development and commercialization of important indications in the global cattle market. As part of the collaboration deal, Axiota Animal Health also made a direct investment in Resilient Biotics and anticipates a multi-year effort to develop a portfolio of new products.

|

Jon Lowe, CEO of Axiota Animal Health, said this agreement reaffirms Axiota’s commitment to seek innovative solutions for their customers. “Combining Resilient Biotics’ advanced microbiome genomics and data science with Axiota’s proven ability to develop and commercialize novel microbes will allow us to better serve the cattle industry with first-in-class products that address our customers’ animal health, welfare, environmental, and economic goals. The innovation resulting from this collaboration will be a great fit with our existing LactiproNXT®, LactiproFLX®, and Multimin® 90 portfolio and enhance the value we bring to customers."

Read the rest of this story about Resilient Biotics here |

|

|---|

|

Sway Success Story: Aledo ISD

|

|

|---|

|

In Aledo Texas, winning State Championships is not only a goal, but an expectation. Consistently winning requires athletes to stay healthy throughout the season, and returning to play as quickly as possible after an injury occurs. This is where Troy Little, Head Athletic Trainer at Aledo ISD, and his staff excel. When looking for a new tool to help them win, they turned to Sway.

The Problem

Aledo ISD was specifically looking for a way to improve their processes throughout Baseline Testing, Sideline Evaluations, and the Return-to-Play. In addition to the issue that their current solution did not include objective balance measures, Aledo ISD’s existing tool presented a few pain points:

- Baseline Testing was time consuming, cumbersome, and required a computer lab.

- The existing tool did not have a solution for Sideline Evaluations.

- There was not a way to digitally or remotely monitor the athlete’s concussion symptoms throughout Return-to-Play.

Switching to Sway

Aledo ISD uses Sway for balance and cognitive testing as well as for tracking concussion symptoms throughout the entire injury cycle. Troy and his team switched to Sway in 2017 and since then have been able to baseline athletes in a fraction of the time. They can also easily perform sideline assessments and make an educated Return-to-Play decision.

Read more of this story about Sway Medical here

|

|

|---|

|

Study Validates the First Automated Chest Tube Clearance System for Cardiac Surgery

|

|

|---|

|

July 26, 2022

Note: Centese is an iiM Portfolio Company

|

|

|---|

|

OMAHA, Neb., July 26, 2022 (GLOBE NEWSWIRE) -- Centese, Inc. announces the first peer-reviewed clinical study on its Thoraguard® digital drainage system for cardiac surgery at Stanford University Medical Center, published in the Journal of Thoracic and Cardiovascular Surgery Open. Thoraguard is the first and only digital chest tube management system that provides automated clog clearance without human intervention while continuously and precisely monitoring critical physiological parameters to inform clinical decision-making and optimize outcomes.

The study found that Thoraguard is safe and effective compared to conventional analog chest tubes when used following cardiac surgery (the study's primary endpoints). The authors noted that the Thoraguard occlusion (clog) rate (2%) and reintervention rate were exceptionally low. In addition, the automated clog clearance function enabled cardiac surgeons to use smaller chest tubes than conventional tubes for enhanced patient comfort.

"This study shows that the future of cardiac surgery and chest drainage is upon us. Our surgical tools must be digitally enabled to keep pace with technological advances in the field," commented Jack Boyd, MD, clinical associate professor of Cardiothoracic Surgery at Stanford University Medical Center and the principal investigator of the study.

Read the rest of this story about Centese here

|

|

|---|

|

A Look at a Portfolio Company

|

|

|---|

|

We are pleased to have made 30 investments in 20 companies within the iiM portfolio with due diligence underway for additional investments. One of our more recent portfolio companies is The Bee Corp, with operations in Indianapolis, IN.

|

For growers who rent beehives, The Bee Corp. offers Verifli, an infrared (IR) image analysis tool that allows growers to measure pollination value, determine pricing and protect yield. The company replaces manual inspections by using infrared imagery and data analytics to predict the size of the colony inside the hive. This is faster than manual inspections, more objective and non-invasive, so no pollination time is lost. The image is captured with a camera sourced through a hardware partner, and the company’s mobile app is used to upload the images and tag them with the appropriate metadata. The colony size is reported back to the grower in a web application. These reports allow growers to ensure their hives are strong enough to result in good pollination in any weather. They are also used to ensure the growers are getting what they pay for from the beekeepers and price the pollination payments. The technology is built out, and The Bee Corp. is now adding features and optimizing performance for their growers.

Ellie Symes (CEO) and Wyatt Wells (CMO) cofounded The Bee Corp. over five years ago but have been working together on their beekeeping passions since 2013. The current team is 12 full time employees and 5 part time interns, with a combined 94 years of experience in their respective fields. They have been offering thermal analysis tools for beekeepers for several years. Studying this over diverse seasons and weather has helped the company build proprietary insight into the complex thermodynamics of beehives, providing a competitive advantage.

What beekepers gain from unbiased grading (company blog post):

Grading hives after they’re shut down for winter is one of many ways that beekeepers can use Verifli to their advantage. What are some other instances when a snapshot of your inventory would be nice to have but impossible to collect on your own? Here are a few ideas:

- Protect your assets: Verifli’s unbiased third-party assessments act as time-stamped receipts of your inventory, making it easy to prove your losses if you need to file an insurance claim. Especially handy when your bees are left in the care of cold storage facility operators, truckers or pesticide applicators.

- Book new business: Use results from past seasons to gain leverage when negotiating new pollination contracts with prospective growers.

- Assess inventory prior to closing hives for winter: Determine which hives to place in cold storage and estimate where hive quality will be in January.

- Monitor colony strength in cold storage: Track status throughout winter; Forecast which hives aren’t strong enough to ship for pollination; Give growers advanced notice on strength concerns or difficulty meeting quota.

- Grade an entire truckload of hives in minutes: Get a snapshot before they depart and as soon as they arrive.

- Confirm initial strength as you place hives in the orchards/fields: Provide proof of delivery to growers and identify weak colonies to swap out before bloom.

- Determine colony strength at bloom: Get paid based on the pollination value of your bees.

- Make sure colonies grew as expected after bloom: Insure hives against spray exposure.

iiM made an initial investment in The Bee Corp for preferred stock in May 2022.

Company Website

|

|

|---|

|

|

iiM (Innovation in Motion) is a funding platform for early-stage companies in the Animal Health, Human Health and Agriculture verticals. The company invests $100,000 - $500,000 in selected companies totaling over $6 million to date. iiM is building a diversified portfolio making 30 investments in 20 companies – with a target of at least 30 to 40 portfolio companies. A professional staff guides 37 investors making investments across the United States and Canada.

The iiM Syndicate entitles its members to participate in all the iiM meetings and pipeline calls; review prospective investments; view due diligence materials and invest only in those companies that each member chooses. And an investment can be as little as $5,000.

Why a syndicate? Syndicate members invest alongside iiM Investor Members to produce a cumulative capital investment that is meaningful to new portfolio companies. Further, if the capital commitment is large enough, iiM may be in a position to lead the investment round and secure even better terms and conditions for all investors. In one investment, Investor and Syndicate members pooled capital totaling $530,000 to invest in a Series A Preferred Stock round. Syndicate members must be Accredited Investors and pay $2,500 per year to participate.

If you are interested in attending an iiM meeting or want more information about the iiM Syndicate, please contact Lydia Kinkade, Managing Director, at lkinkade@iimkc.com or (913) 671-3325. The iiM website is www.iimkc.com.

|

|

|---|

|

|

| |

|

|